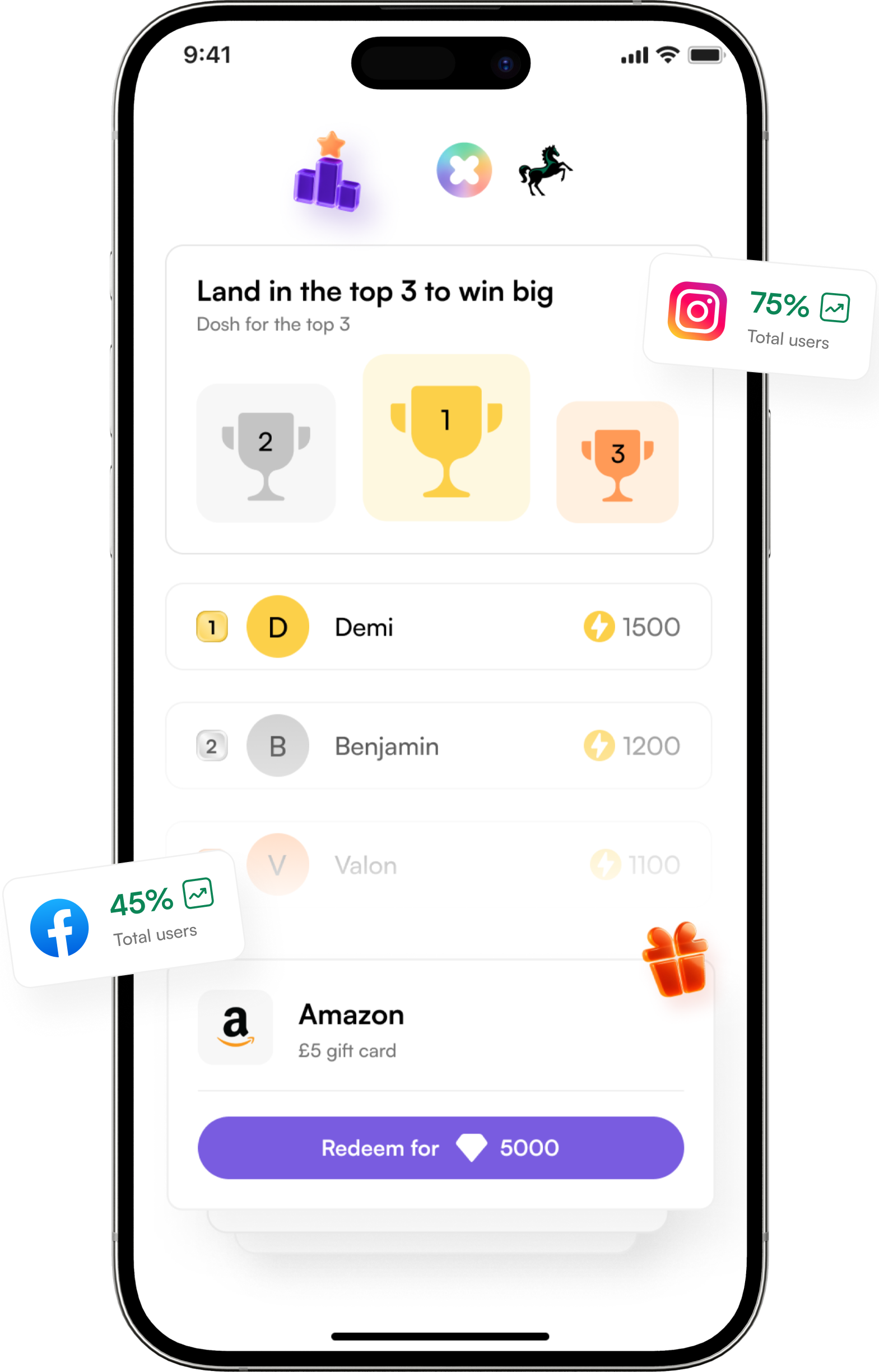

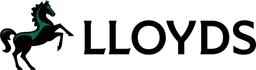

- Lower cost per acquisition versues traditional channels

- Reaches younger demographics via performance marketing

- Build a highly qualified lead list before conversion

75%

lower cost per acquisition

The AI-native engagement layer that personalises every interaction and drives meaningful loyalty and conversions.

Driving Impact With Leading Financial Institutions

The customer outcome I'd like to achieve is...

75%

lower cost per acquisition

9x

Increase in CTR v Google Ads

28%

Average CTR across partners

35%

Adoption inside the first 6 months

6x

ROI through churn reduction

Behaviour-changing financial journeys that help your customers progress — and strengthen your brand.

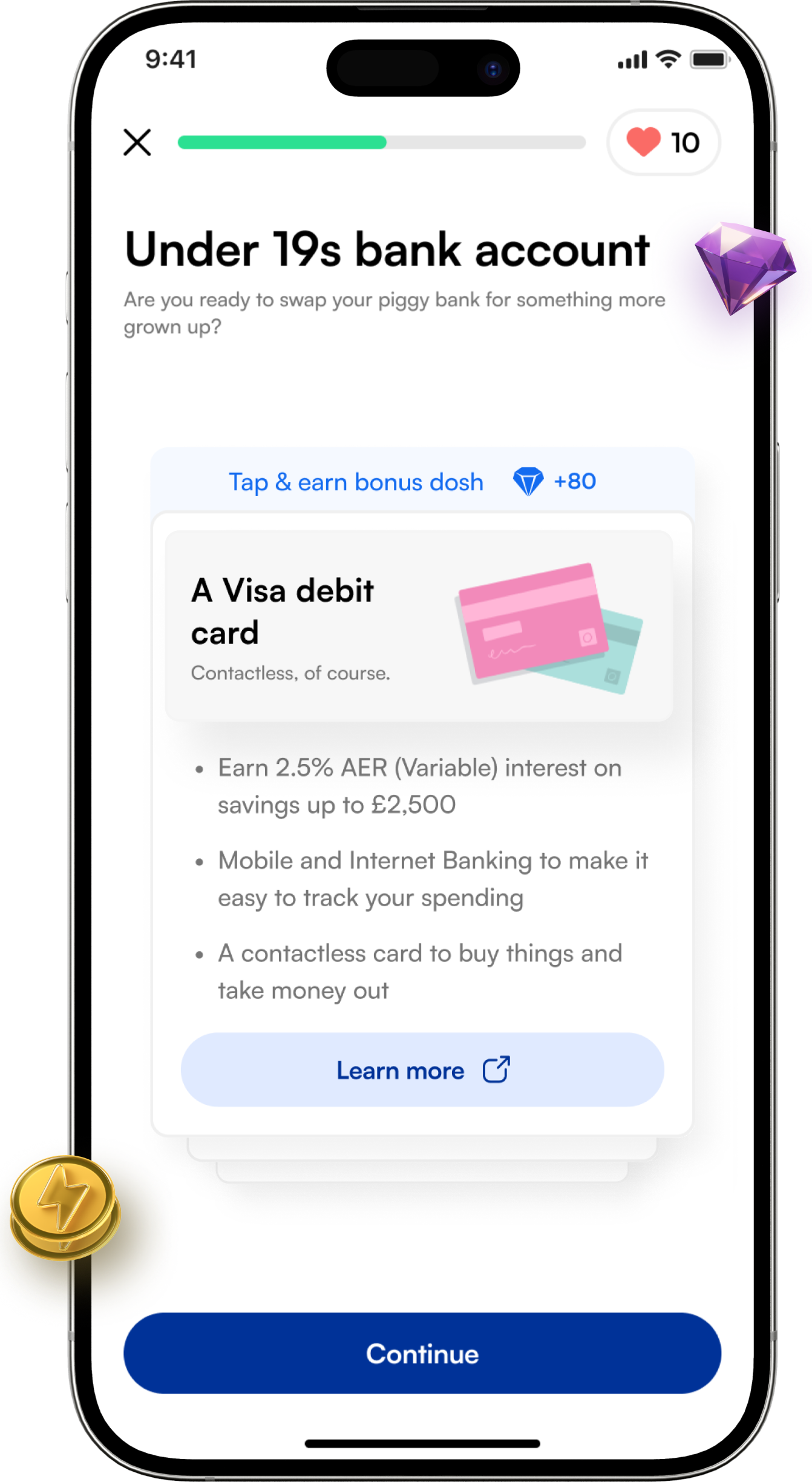

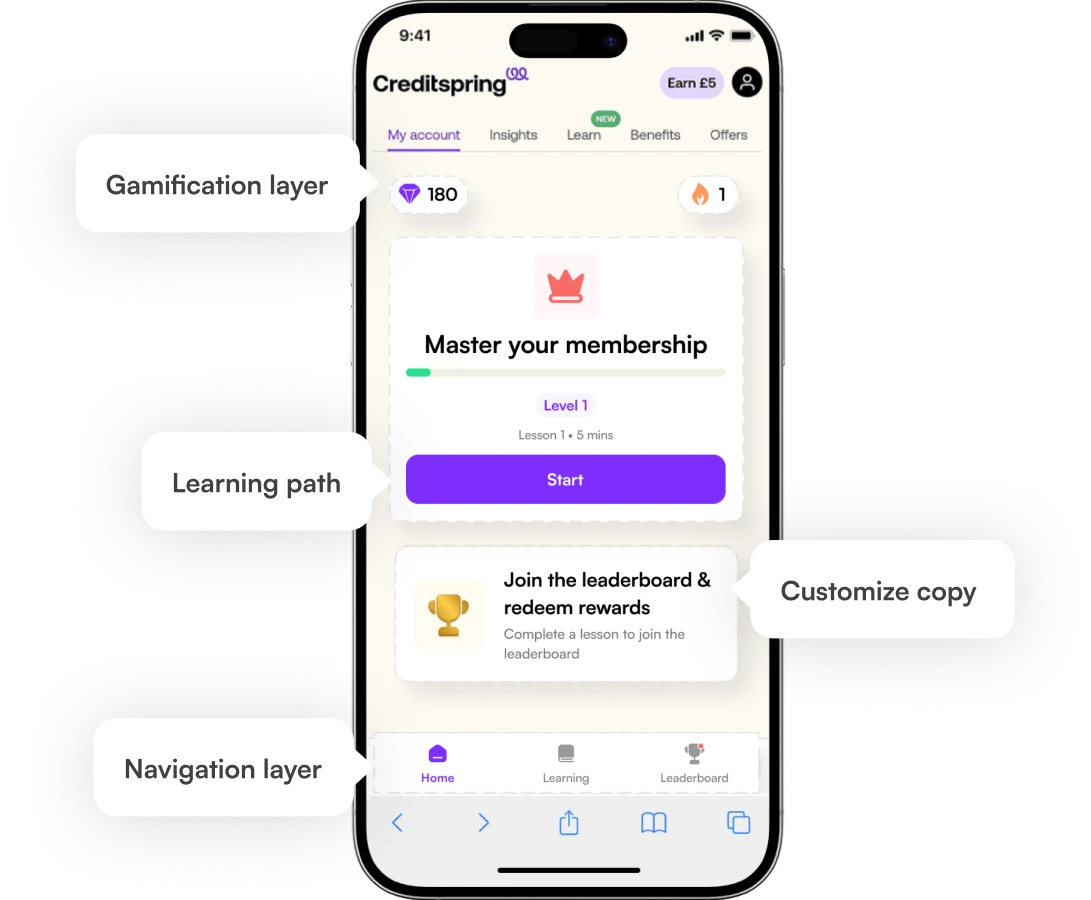

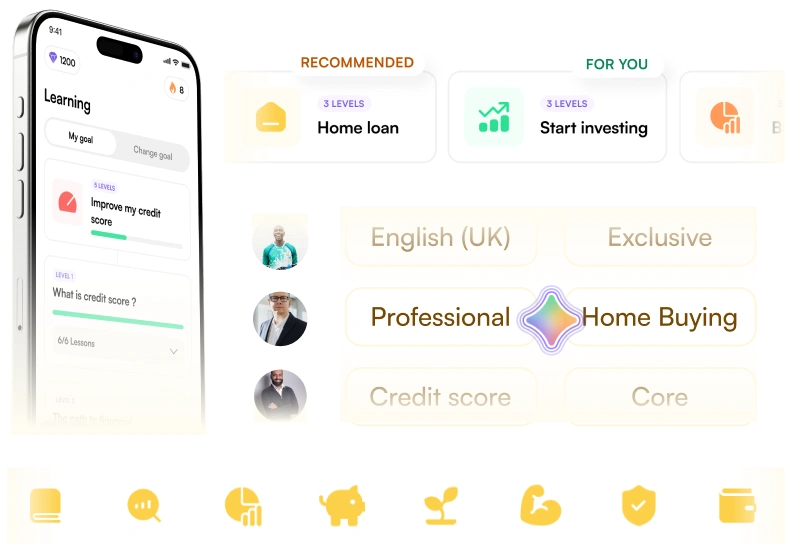

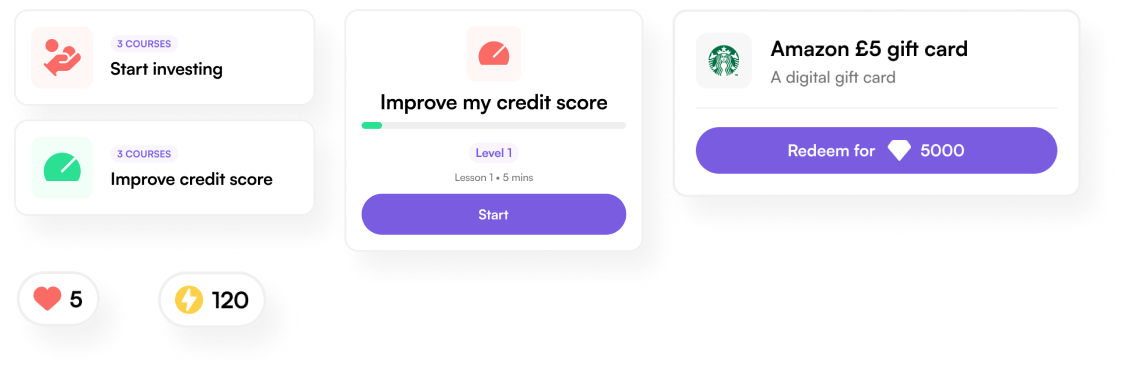

Every life moment is different. Doshi personalises each one -building credit, investing, or home buying -with evergreen content that stays relevant for every segment.

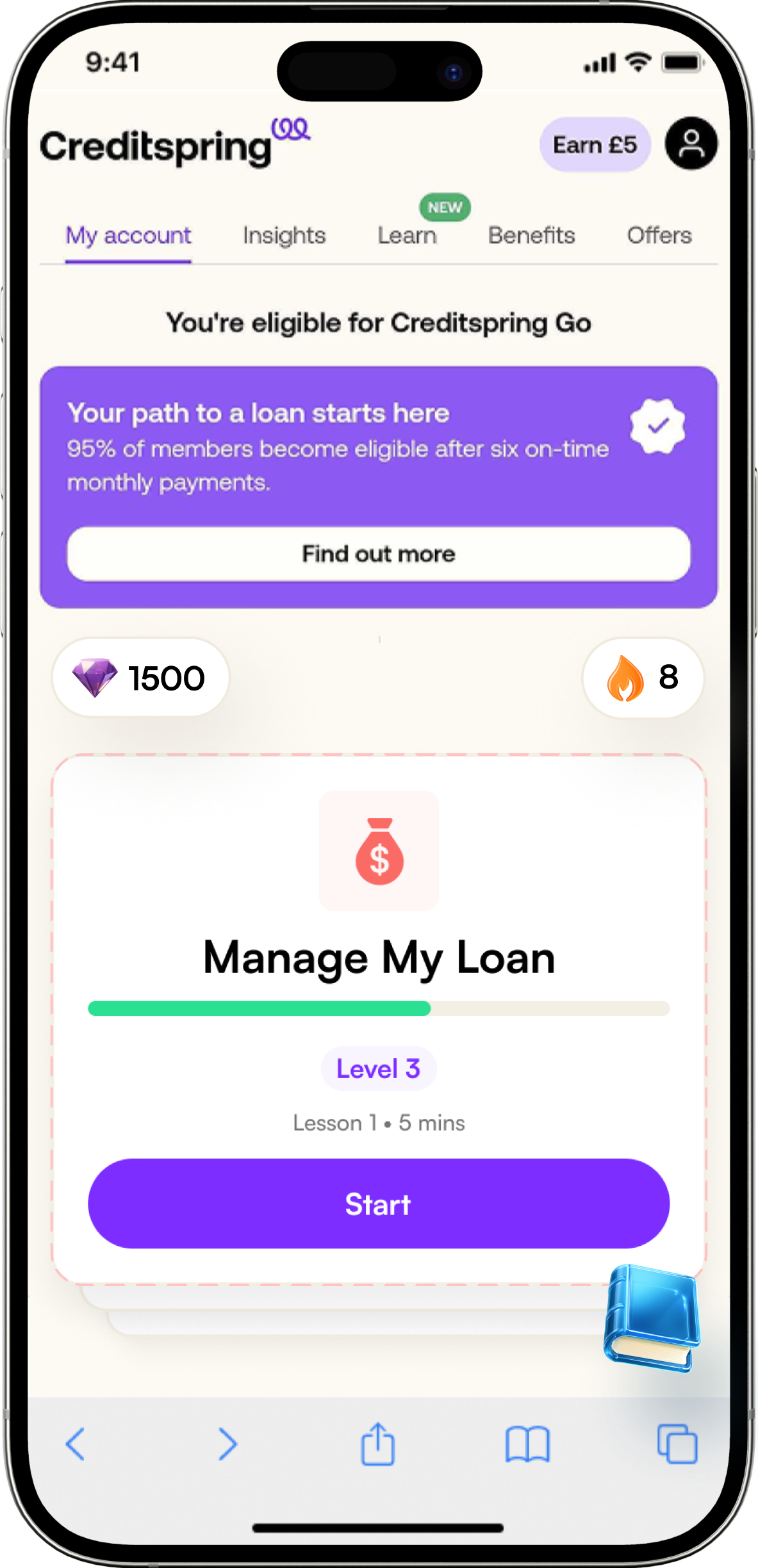

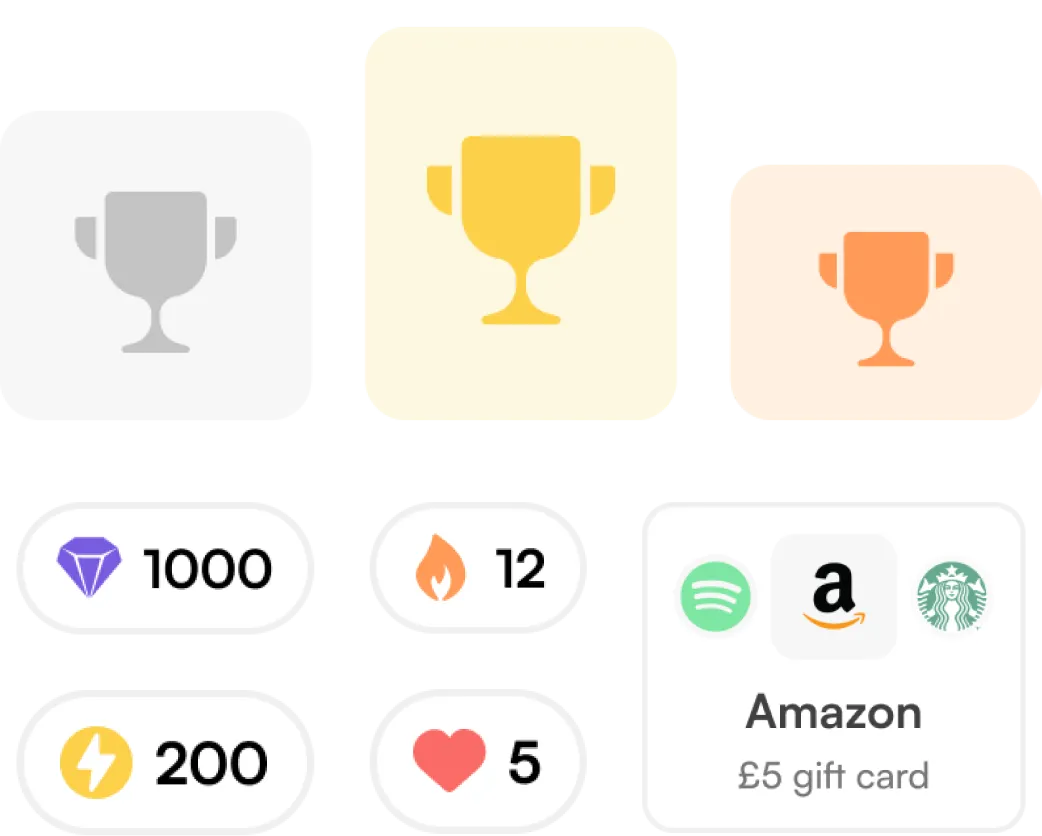

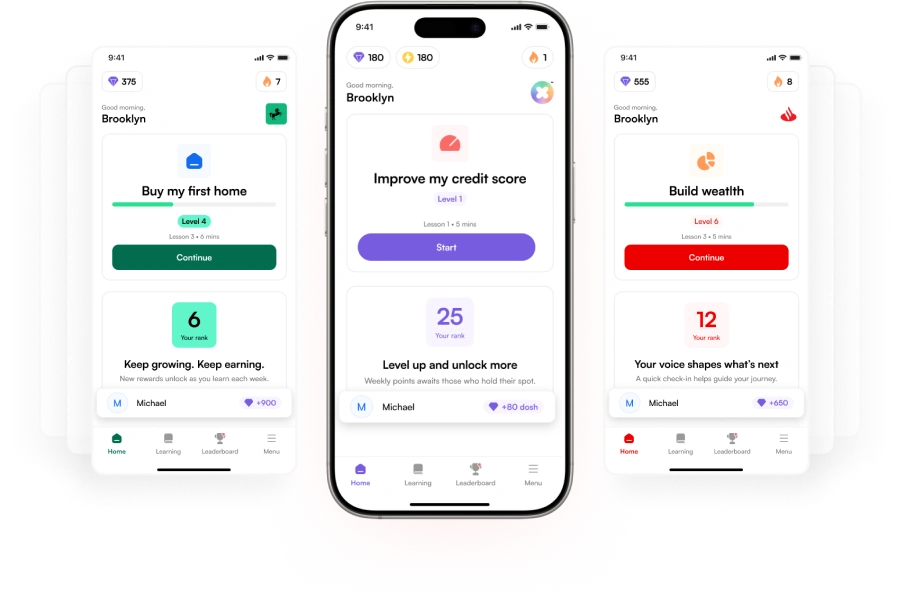

Turn your customers’ financial goals into habits. Gamified streaks, leaderboards, and rewards drive consistent engagement and deeper loyalty.

We translate and localise all content to match your market’s language, culture, brand tone, and compliance standards.

Whether you serve 1,000 users or 1 million, Doshi delivers consistent, reliable performance.

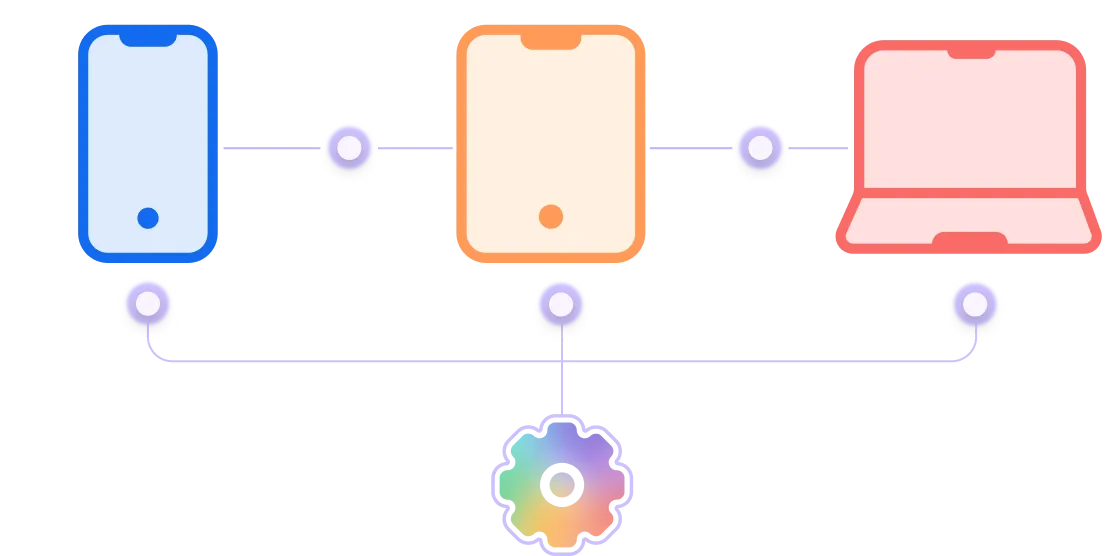

Embed Doshi wherever your customers are - your website, your app, or any digital channel.

Doshi

Education isn't an add-on. It's your competitive edge

88%

Money confidence

65%

Conversion

300K

Active users

8X

Retention

88%

Money confidence

65%

Conversion

300K

Active users

8X

Retention

88%

Money confidence

65%

Conversion

300K

Active users

8X

Retention

75/100

Risk Score

4.2/5

Financial knowledge

90%

Lesson completion

80%

Engagement

75/100

Risk Score

4.2/5

Financial knowledge

90%

Lesson completion

80%

Engagement

75/100

Risk Score

4.2/5

Financial knowledge

90%

Lesson completion

80%

Engagement

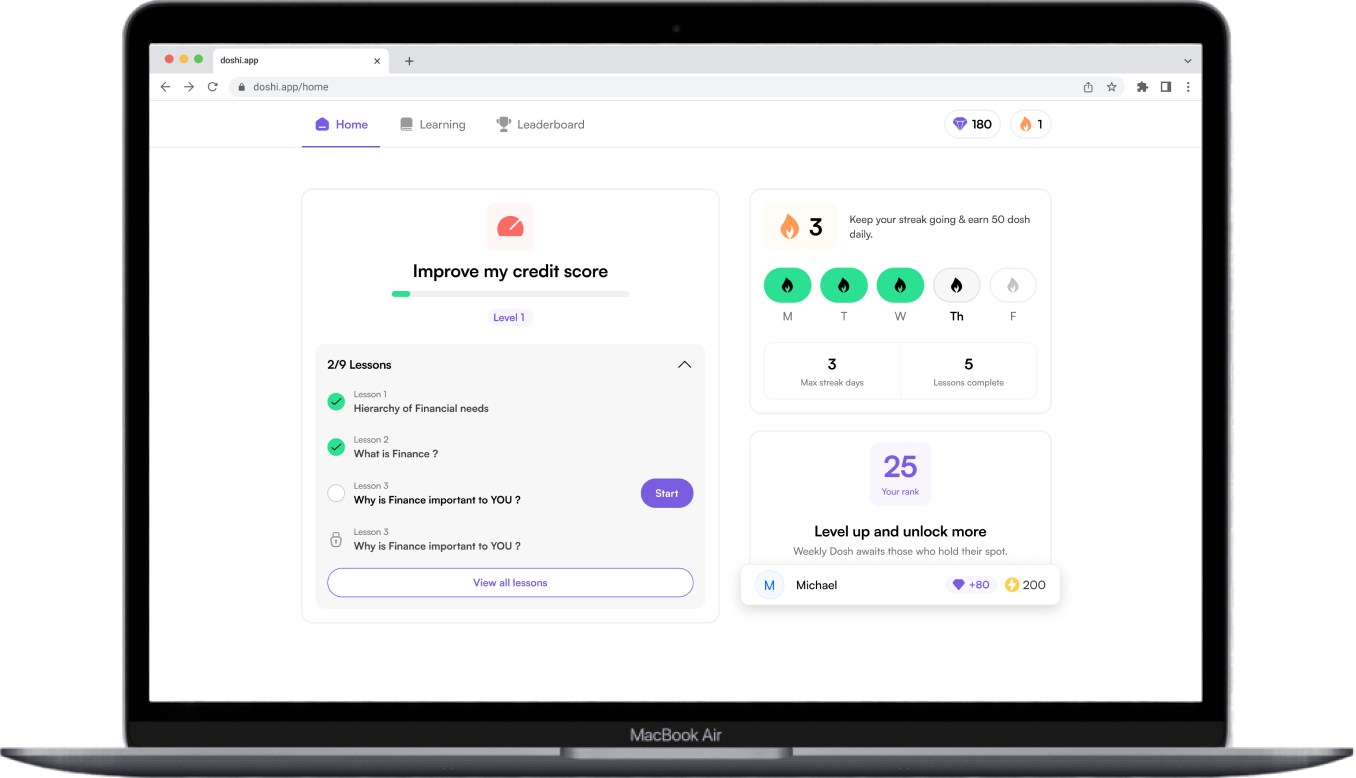

Integrate Doshi directly into your app or launch it as a standalone experience. The same behaviour-changing journeys, delivered your way.

A native-feeling experience that delivers behaviour-changing financial journeys inside your existing app or website — fully adapted to your brand.

A single CMS for designing lessons, launching surveys, configuring rewards, and previewing full journeys — simple for every team, powerful at scale.

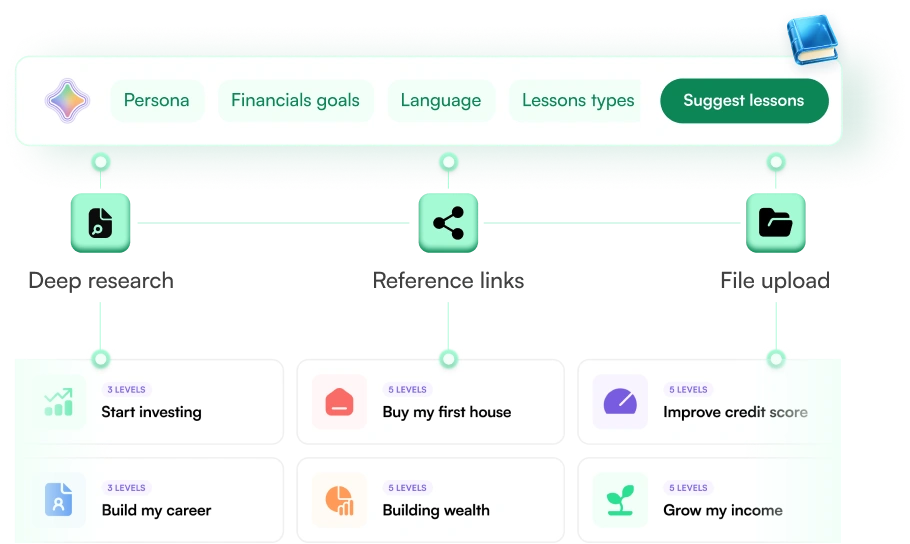

Produce lessons at scale using your policies, content, and brand voice. Start from our library of 1,000+ modules or generate new ones instantly with AI — all automatically checked for compliance.

Deliver adaptive learning paths that personalise lessons based on user inputs, personas, and financial goals — ensuring each customer gets the right content at the right moment.

See exactly how lessons, journeys, and rewards look with your fonts, colours, and design tokens applied — ideal for compliance reviews, internal sign-off, and user testing.

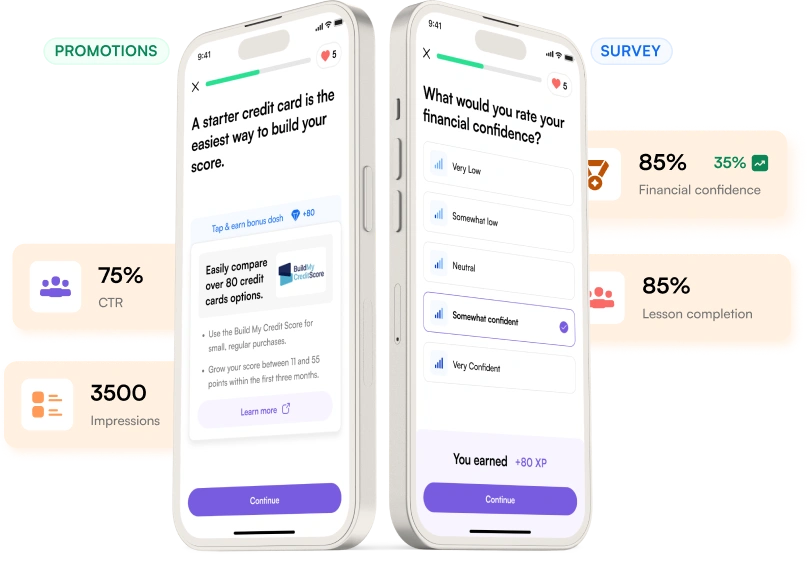

Collect real-time insights with in-lesson surveys, then trigger personalised financial promotions based on personas or actions — educating first, converting with trust.

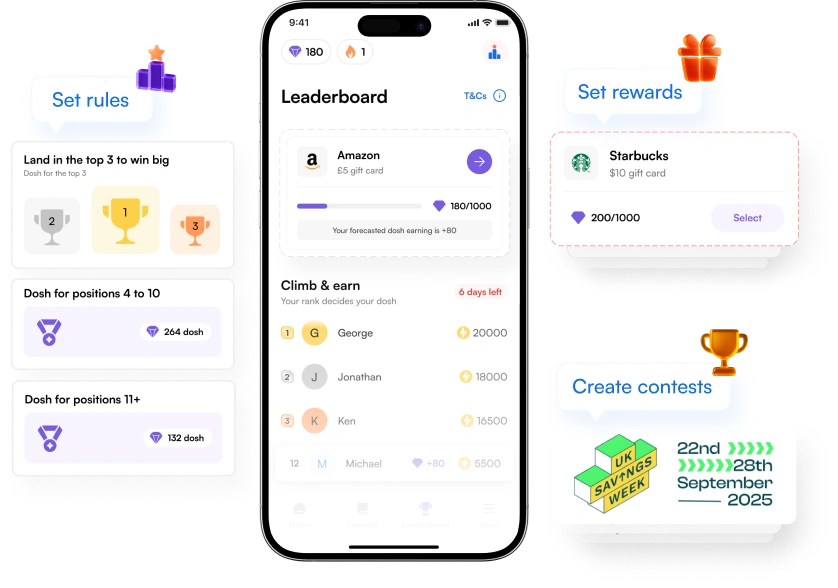

Set up custom leaderboards, budgets, and incentives — from gift cards to in-bank benefits. Fully configurable and webhook-ready for your existing rewards systems.

Doshi plugs into your current systems, channels, and customer journeys - enabling financial education at scale with minimal integration effort.

View DocumentationDrop lightweight modules, like “Doshi Balance” or “Start a Lesson”, directly into your app or website. Style them to match your design system, and even link components to transactions (e.g., after an overdraft fee, surface a savings lesson).

Embed full experiences, such as leaderboards, journeys, or your home learning hub, as seamless Webviews to launch end-to-end engagement instantly.

Access aggregated analytics through your BI tools - giving you clear visibility into engagement, performance, and early growth signals across your customer base.

Connect Doshi behaviours to your CRM to understand user intent, reduce fraud and default risk, and trigger targeted notifications at the right moment.

Use the same API that powers Doshi’s own modules - so you can build custom components, design new experiences, and keep everything perfectly on-brand.

4.8 / 5.0

App Store Rating

+200k

Users

2M+ hrs

Hours of learning

+70%

Active learners

Doshi integrates seamlessly with leading banking service providers making it easy to activate financial education and engagement within your existing infrastructure.

We partner with leading banking platforms, associations, and institutions to accelerate adoption, expand reach, and deliver impact across credit unions, community banks, and financial ecosystems.

We work with digital banking and Banking-as-a-Service providers in the UK, US, and Canada to accelerate adoption for credit unions and community banks — enabling seamless deployment through your existing platform.

Turn everyday banking interactions into meaningful engagement that drives activation, product uptake, and retention. Differentiate your digital experience and compete with neo-banks through personalised financial journeys.

Deliver accessible, personalised education rooted in member needs and community values. Build lasting loyalty, support financial wellbeing, and attract younger members to sustain long-term growth.

Help customers borrow confidently with contextual learning at key decision moments. Improve credit readiness, reduce defaults, and strengthen repayment behaviour - driving healthier portfolio performance.

Empower members with guided learning tailored to life milestones - from homeownership to saving habits. Strengthen trust, deepen relationships, and support financial resilience across generations.

Hear how customers use Doshi to drive loyalty, insight, and meaningful customer progress.

Doshi enables us to offer accessible, digital-first financial education that helps our members make informed decisions and build healthier money habits.

Ryan Young

CFO, Manchester Credit Union

We have enhanced our customers’ financial literacy whilst deepening engagement with our products. It has made finance more approachable and engaging, creating significant value for our members.

Pooja Rohra

Head of Marketing, Creditspring

We now deeply understand how young professionals engage with financial tools. The insights we gained were instrumental in shaping our approach to long-term financial wellbeing.

Kam Ahir

Senior Innovation Manager, Santander

Doshi offers us the ability to improve our communities and drive people to their local high street.

Alex Memmott

Head of Marketing, Furness

We’ve been impressed both by the range and depth of learning available and the user-friendly, intuitive way of Doshi’s learning experience.

James Richards

Strategic Partnerships, Commsave Credit Union

Celebrated for innovation and customer impact. Trusted by leading institutions through award-winning learning and industry-backed pilots.

Enterprise-grade protection built for regulated industries. Secure, compliant, and accessible — ready for safe deployment at scale.

Let’s talk about how Doshi can help you grow. Book a time that works for you — right here, instantly.

“Looking forward to understanding your goals and showing what’s possible.”

CEO & Co-Founder, Doshi